WHAT IS PROTECTION?

"Your Home Is At Risk If You Do Not Keep Up Repayments On A Mortgage Or Other Loan Secured On It"

To most of us, this is just a legal warning to remind us that we don't own our home outright until we've paid off any loans secured on it. However, what we should all be thinking about is what may happen that might cause us to not keep up with the payments, what's important for us to protect, and then, what steps we could take to mitigate these risks...and for me, taking out suitable, affordable protection is paramount to ensuring we can all keep our homes should the worst happen.

There are numerous different protection plans available, but the main types of cover are briefly covered below...

Life INSURANCE

What is Life Insurance?

Life Insurance could pay a lump sum of money to your loved ones should you pass away during the term of your policy.

Life Insurance helps you protect the ones you love should the worst happen.

It pays out a cash lump sum if you pass away during the policy term, over this period you pay monthly premiums to the insurance company.

Why should you consider Life Insurance?

Everyone’s circumstances are different. Your children, partner or other relatives may depend on you financially to cover things like the mortgage, household bills or other living expenses. Life Insurance will help provide for your family in the event of your death.

How does Life Insurance work?

You can choose the amount of cover you need and for how long.

Your premiums won’t change in the future unless you choose inflation-linked cover or make changes to your policy.

You may be able to increase your cover, subject to age and cover limits, after specific life events without providing medical evidence.

What you pay depends on your personal circumstances such as your age and whether you smoke.

This is a protection policy only and has no cash value. If you stop paying your premiums, your cover may stop and you won’t get any money back.

life & CRITICAL ILLNESS

What is Life and Critical Illness Cover?

Life and Critical Illness Cover could pay out a lump sum should you die, or be diagnosed with one of the serious illnesses or conditions listed in your policy conditions (and survive for at least 14 days).

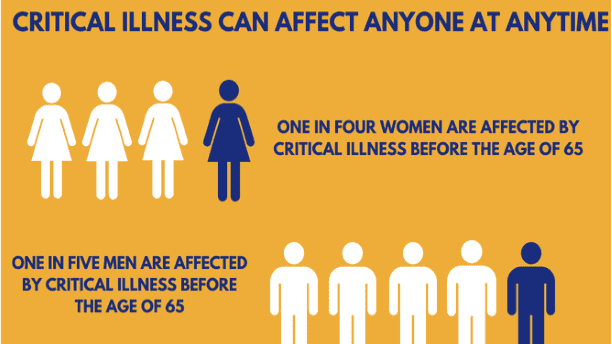

Why should you consider Life and Critical Illness Cover?

1 in 2 of us will get cancer in our lifetimes.

Source: Cancer Research UK

https://www.cancerresearchuk.org/health-professional/cancer-statistics/risk

Source: Stroke UK

https://www.stroke.org.uk/what-is-stroke/stroke-statistics

Around a quarter of deaths in the UK are heart-related.

Source: British Heart Foundation

https://www.bhf.org.uk/what-we-do/news-from-the-bhf/contact-the-press-office/facts-and-figures

Life and Critical Illness Cover can protect your home, family and lifestyle providing one less worry during a difficult time.

How does Life and Critical Illness Cover work?

Many insurers have two options of Life and Critical Illness policies depending on your needs and budget.

A) Life and Critical Illness Standard Cover

Covers up to c.50 conditions (including the illnesses you’re more likely to claim on).

Doesn’t include Children’s Cover unless added for an additional cost

or

B) Life and Enhanced Critical Illness Cover

Covers a greater range of conditions for added peace of mind. This typically includes Standard Children’s Cover automatically for your children up to age 23

This is a protection policy only and has no cash value. If you stop paying your premiums, your cover may stop and you won’t get any money back.

INCOME PROTECTION

What is Income Protection?

Income Protection could replace up to 60% of your monthly earnings on a claim for any physical or mental illness or injury that prevents you from doing your job, not just any job, unless there is a specific illness excluded from your policy.

Income protection covers many more illnesses than the critical illness insurance, including, for example, mental health issues, musculoskeletal problems (e.g. bad back), hip/knee problems, gastro problems and many more.

It pays a monthly amount after your selected waiting period until you’re able to return to work, until the end of your policy or until you die.

Many insurers offer budget options with all the same features that pay out for a maximum of 12 or 24 months for each claim.

What is a waiting period?

Your waiting period is how long you wait before your policy starts paying out if your claim is accepted. You can choose 1, 2, 3, 6, or 12 months. The longer the waiting period, the more affordable the monthly premium can be.

Why should you consider Income Protection?

Did you know...a non-smoking couple in their mid-30’s have a 60% chance of being unable to work for 2 months or more due to illness or injury before they retire at age 68?

Income Protection can help minimise the financial impact of ill-health, and support you and your family’s current lifestyle and financial commitments.

Similarly to life insurance & critical illness, this is a protection policy only and has no cash value. If you stop paying your premiums, your cover may stop and you won’t get any money back.